Mutf_In: Icic_Prud_Ener_Qjge8q exemplifies a methodical approach to sustainable investment. By marrying rigorous analytics with innovative strategies, it seeks to generate economic growth while minimizing ecological impact. The fund’s commitment to biodiversity and carbon reduction aligns with emerging regulatory trends. However, the complexities of implementing such practices may present challenges. Understanding these dynamics is crucial for evaluating the fund’s potential efficacy and overall impact.

The Innovative Framework Behind Mutf_In: Icic_Prud_Ener_Qjge8q

The framework underlying Mutf_In: Icic_Prud_Ener_Qjge8q exemplifies a strategic integration of innovative investment methodologies and rigorous analytical processes.

It incorporates sustainable technologies, ensuring alignment with evolving regulatory frameworks. This approach not only mitigates risks but also capitalizes on growth opportunities within the renewable sector, appealing to investors seeking freedom in their financial pursuits while fostering environmental responsibility and compliance with industry standards.

Environmental Impacts and Benefits

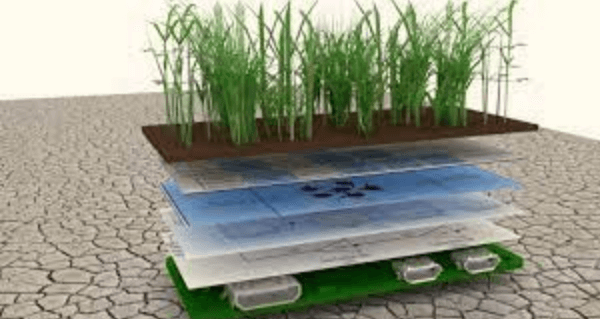

Mutf_In: Icic_Prud_Ener_Qjge8q significantly influences environmental outcomes through its commitment to sustainable investment practices.

By prioritizing ecological restoration projects, the initiative fosters biodiversity and enhances ecosystem resilience.

Quantitative assessments indicate a measurable reduction in carbon footprints and improved resource management.

Such sustainability practices not only mitigate environmental degradation but also promote a healthier planet, aligning with the broader goal of fostering freedom through ecological stewardship.

Economic Growth and Implementation Challenges

While striving for economic growth, Icic_Prud_Ener_Qjge8q encounters several implementation challenges that require strategic navigation.

These challenges include aligning policy implementation with the principles of sustainable development, addressing resource allocation inefficiencies, and overcoming bureaucratic inertia.

Effective solutions necessitate data-driven approaches and stakeholder engagement to ensure that growth objectives do not compromise environmental integrity or social equity, ultimately fostering a resilient economic framework.

Conclusion

In conclusion, Mutf_In: Icic_Prud_Ener_Qjge8q emerges as a lighthouse guiding investors toward sustainable opportunities in an increasingly volatile market. By harmonizing economic growth with environmental stewardship, it not only addresses the pressing challenges of climate change but also cultivates a resilient investment landscape. However, the journey ahead necessitates navigating implementation hurdles and adapting to regulatory shifts, underscoring the delicate balance between ambition and responsibility in the pursuit of a greener future.