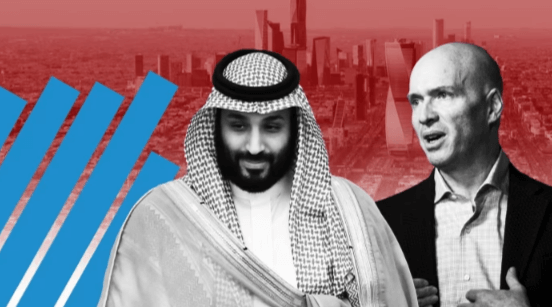

Drawing from a diverse array of reputable channels, Sources Tiger Ivp Vcs Saudi Arabia meticulously sources its investment opportunities to navigate the dynamic startup landscape effectively. By tapping into a blend of market intelligence, expert insights, and strategic alliances within the industry, Tiger Ivp Vcs positions itself as a key player in fostering innovation and growth in the region. The methods by which Tiger Ivp Vcs acquires its investment insights shed light on its unique approach to identifying and nurturing promising startups, setting the stage for a compelling discussion on the efficacy of their sourcing strategies and their impact on the broader entrepreneurial ecosystem in Saudi Arabia.

Investment Focus and Strategy

Consistently focusing on a diversified investment strategy is essential for the success of Tiger Ivp Vcs in Saudi Arabia. By prioritizing investment diversification, the firm can mitigate risks and capitalize on a wide range of growth opportunities.

This approach allows Tiger Ivp Vcs to adapt to market fluctuations and optimize returns for its stakeholders. Embracing a varied portfolio ensures resilience and sustained performance in the dynamic Saudi Arabian market.

Notable Portfolio Companies

One of the standout companies within Tiger Ivp Vcs’ portfolio in Saudi Arabia demonstrates a strong track record of innovation and market growth. This company has attracted significant funding rounds, showcasing its potential for success.

Its story serves as a prime example of adapting to market trends and excelling in industry analysis. Through its achievements and successes, this company has solidified its position as a notable player in the Saudi startup ecosystem.

Impact on Saudi Startup Ecosystem

Tiger Ivp Vcs’ strategic investments have played a pivotal role in shaping the evolution and growth of the Saudi startup ecosystem.

Their contributions align with government support initiatives, fostering an environment conducive to innovation and entrepreneurship.

Through technology adoption, Tiger Ivp Vcs has helped drive digital transformation, empowering startups to develop cutting-edge solutions and compete on a global scale.

These efforts have significantly influenced the trajectory of the Saudi startup landscape.

Future Prospects and Trends

The evolution of the Saudi startup ecosystem, propelled by strategic investments from Tiger Ivp Vcs, sets the stage for an exploration of future prospects and emerging trends in the industry.

With a focus on emerging technologies and global market expansion, Saudi Arabia is poised to witness a surge in innovative solutions and increased international partnerships.

These developments are likely to shape the landscape of the Saudi startup ecosystem in the coming years.

Read Also Example Firewall Llmsdotsonsiliconangle

Conclusion

In conclusion, Sources Tiger Ivp Vcs Saudi Arabia utilizes a diverse range of sources to inform its investment decisions and drive growth in the startup ecosystem.

One interesting statistic is that Saudi Arabia’s startup ecosystem has seen a significant increase in funding, with total venture capital investments reaching $67 million in the first half of 2021, highlighting the potential for continued growth and innovation in the region.