Financial Opportunity Mapping serves as a critical framework for understanding the distribution of financial resources within communities. By examining specific data points, such as 7252934857 and 7372701017, analysts can identify significant trends and access gaps. This method not only informs strategic decision-making but also highlights investment opportunities. The implications of these findings extend beyond mere statistics, hinting at broader economic transformations waiting to be explored.

Understanding Financial Opportunity Mapping

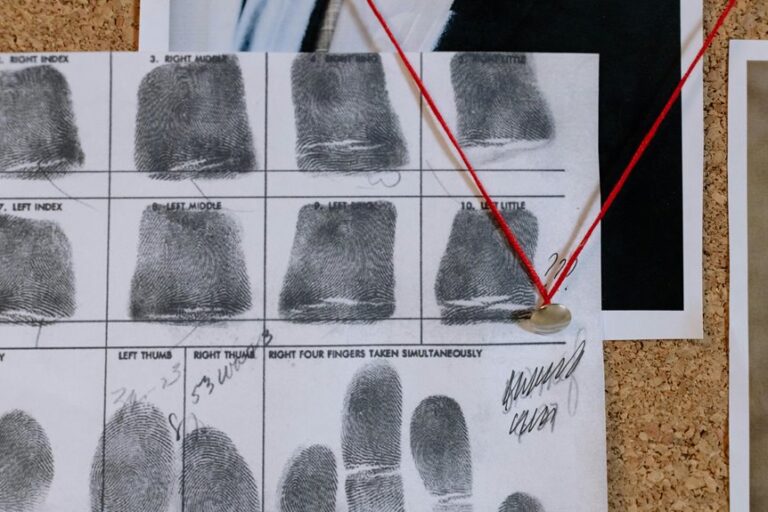

Understanding Financial Opportunity Mapping involves analyzing the spatial distribution of financial resources and services, as well as identifying gaps in access for various communities.

This process incorporates financial trends, investment strategies, and risk assessment to inform market analysis.

Analyzing Key Financial Data Points

How can the analysis of key financial data points inform strategic decision-making in financial opportunity mapping?

By evaluating financial metrics through data visualization, stakeholders can identify trends and patterns that facilitate informed choices.

This analysis enables a clearer understanding of potential investment opportunities, optimizing resource allocation and enhancing overall financial strategy.

Ultimately, it empowers organizations to navigate the complexities of the financial landscape more effectively.

Leveraging Insights for Economic Growth

The insights gained from analyzing key financial data points play a pivotal role in fostering economic growth.

By identifying emerging investment trends, stakeholders can develop targeted economic strategies that enhance resource allocation and optimize returns.

This data-driven approach empowers communities to harness their financial potential, ultimately contributing to sustained economic prosperity and individual freedom within the marketplace.

Conclusion

In a world where financial opportunity mapping relies on seemingly arbitrary numbers, one must ponder the irony: are we truly translating data into equity, or merely dressing up spreadsheets in a cloak of sophistication? As communities await their turn at the financial feast, the gap between resource allocation and need grows ever wider. Perhaps, while we analyze these figures, we should also consider whether our metrics are paving roads to opportunity or merely drawing lines in the sand.